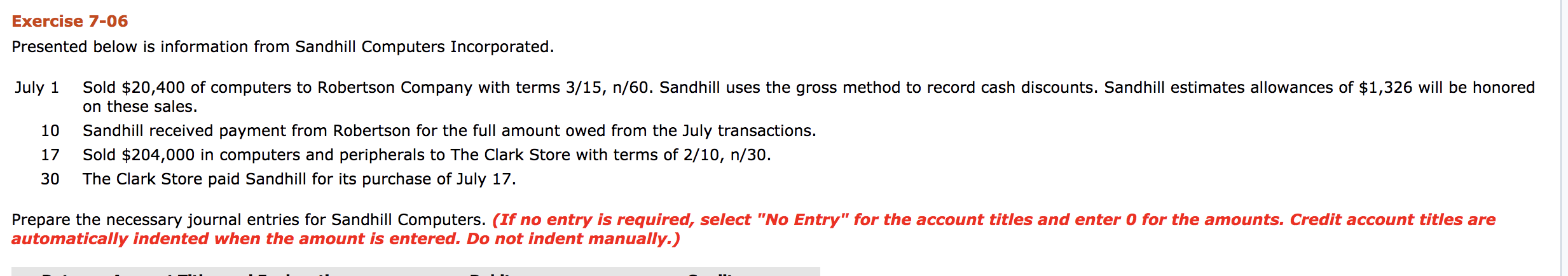

-

- 05 Jan

Sources: ECB, Eurostat, Lender for International Settlements

Sources: ECB, Eurostat, Lender for International Settlements Graph step one.six

Sources: ECB, Bloomberg Money L.P., European Payment and you may ECB data.Notes: Committee a: interest rate susceptibility are determined while the industry beta of sector EURO STOXX sub-list into the German five-season authorities bond over the several months of . Questioned CAPEX shows Bloomberg’s guess of your amount of cash an effective organization uses purchasing investment property or change the established financial support assets. A negative well worth reflects high expenditure. Panel b: simple deviation across 56 NACE Rev. dos circles on the euro area.

Stronger funding criteria have started getting an impact on firms’ debt provider costs and you may issuance actions. Since the monetary requirements has fasten, one another areas and you will banking companies possess reassessed the dangers related corporate activity. Therefore, the cost of obligations has increased dramatically as mid-2022 (Chart step 1.eight, panel a beneficial). Websites credit moves dropped right back highly in the first days off 2023 since it became more costly so you can roll over obligations, exhibiting deleveraging in certain regions and you will circles. In the 2022 higher rates and higher working capital needs on the account of highest development costs plus triggered a change from long-name credit so you can money with a shorter readiness. The outcomes of ECB’s Q1 2023 lender lending questionnaire indicate the increase in the general level of rates of interest, also a pencil demand for the financing. Additionally, this new feeling away from firmer borrowing from the bank standards you are going to build-up over time, with a put-off violation-till the genuine interest off organizations. In a few euro area places, highest debt service requires are followed by down attention coverage rates, and you can corporates might possibly be influenced a whole lot more of the ascending rate environment.

At the same time, corporate balance sheets in the most common euro city countries are currently healthier than these people were throughout the earlier price-walking schedules. Years of low interest rates and you can a powerful blog post-pandemic recuperation have helped the common corporate to create strength in the see your face from a special downturn and you may easily ascending resource can cost you. Terrible notice visibility percentages features increased, specifically for countries hence become that have low levels of interest publicity on the low-monetary business sector (Graph step one.eight, panel b). Additionally, non-monetary business obligations profile refused to help you 144% out-of terrible value added on the last quarter away from 2022, weighed against 148% before pandemic.

Chart 1.eight

Corporates keeps created strength, however, borrowing from the bank costs are expanding highly and bankruptcies possess found in a few euro urban area regions

Moody’s Analytics, Refinitiv and you can ECB computations.Notes: online payday loans Snowmass Village Colorado Panel b: the debt service proportion is understood to be the latest ratio of interest payments in addition to amortisations in order to earnings. As such, it includes a flow-to-disperse investigations brand new flow out of financial obligation solution repayments separated of the disperse from money.* The interest exposure ratio is defined as the newest proportion regarding terrible functioning excess to terrible attention costs till the calculation of financial intermediation properties indirectly mentioned.*) Get a hold of Just how much money is utilized to have debt costs? Yet another databases getting obligations services percentages, BIS Every quarter Feedback, Lender to own International Settlements, .

Bankruptcies in a number of euro town regions have started to improve away from an incredibly reduced feet, despite the fact that are less than pre-pandemic membership. Bankruptcies for the majority high euro city economies are still below pre-pandemic averages, although they have started to normalise regarding lower levels reached during the pandemic. Moreover, forward-appearing tips getting standard exposure laws increased risk (Chart 1.7, committee c), motivated by the those individuals sectors privately influenced by the ability drama such because transportation and globe.

Business vulnerabilities will be higher than new aggregate means, since not every corporate benefited equally in the blog post-pandemic data recovery. New uneven perception of two succeeding, and extremely other, crises has introduced significant diversity over the mix-part of enterprises that will mean that a financial credit crunch you will do have more really serious effects having economic balance than just which aggregate photo indicates. Furthermore, the fresh new predominance away from varying-rates lending in a number of regions, together with large corporate debt levels by historic and you may internationally conditions, tends to make certain corporates at risk of a deeper otherwise crazy tightening from economic standards. Additionally, debt devices that will be more sensitive to price increases, such leveraged finance, might be instance unsealed would be to economic conditions tighten after that. Therefore, there is more non-payments moving forward, that have possible hit-into the effects on lender balance sheet sets and family employment candidates.